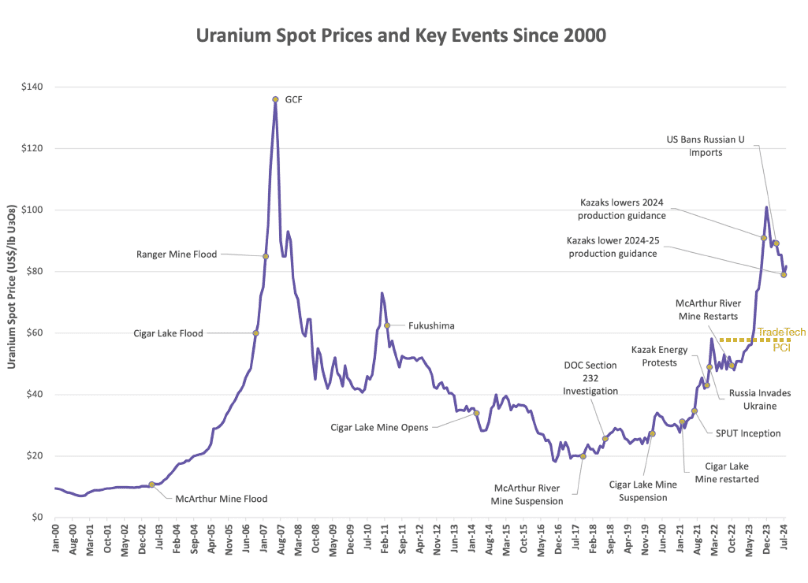

Uranium Prices Are Just Reaching Incentivizing Levels

Sources: Uranium prices from both UxC Consulting and Tradetech, events from various news sources

- Uranium prices respond rapidly to supply disruptions. Current geopolitical events are likely to ensure continued short to mediumterm supply volatility

- TradeTech’s Production Cost Index of US$58.00/lb has only recently been reached. With investors requiring a minimum return on investment, an incentivized price of US$80.00/lb is realistic

- Despite reaching incentivized pricing, chronic underfunding of the uranium exploration and development since 2008 resulted in few projects entering the development pipeline. Development timelines in most jurisdictions is over 10 years

- Current suppliers are unable to elastically respond to price increases and likely will have to prioritize investment in sustaining capital over investing in new production capacity in the medium-term

- Long-term price (US$82.00/lb) has just caught up to the spot price rise suggesting utilities believe that a fundamental change in supply dynamics are in place and that higher prices may linger for a longer period

-

UF6 and EUP prices remain very strong and supply is very tight forcing utilities to purchase U3O8