Why Invest in Uranium Now

Nuclear Power Is Enjoying The Strongest Public Acceptance In Generations

The world has realized that renewables alone cannot be the sole solution to a reliable carbon-free electricity grid. Nuclear is now recognized as a reliable baseload source of carbon-free electricity

Currently there are 67 new reactors under constructionrepresenting a 15% nearterm growth in future nuclear demand. Reversals and curtailments of premature nuclear plant shutdowns is underway

Recent geopolitical events have changed domestic views on energy security. American domestic uranium production is only 2% of US reactor demand. The US ban on Russian U imports puts a premium on US domestic U supply

Governments are incentivizing clean energy projects and growth of the nuclear fuel supply chain, and in the case of Small Modular Reactors even participating in their development

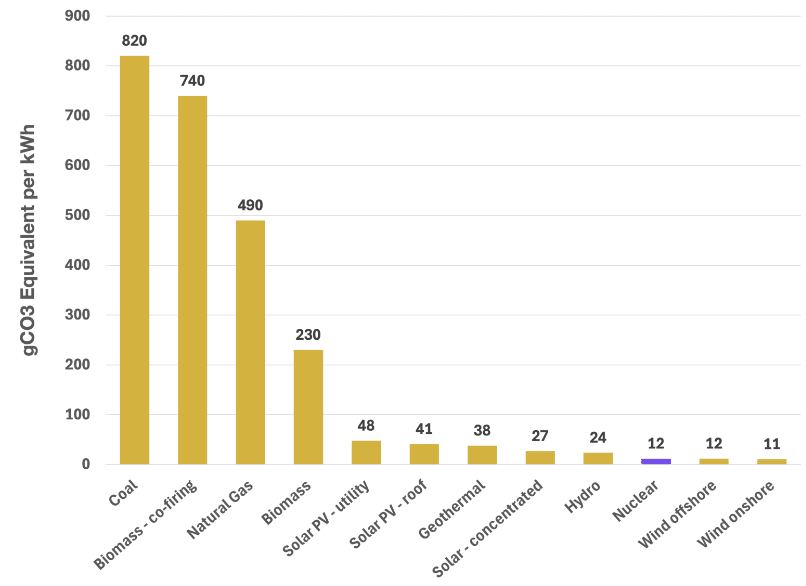

Nuclear Electricity’s Full Life-Cycle Carbon Emissions Per kWh Comparable To Renewables…But Is Reliable

Source: World Nuclear Association website at https://world-nuclear.org/nuclear-essentials/how-can-nuclear-combat-climate-change#:~:text=Nuclear%20power%20plants%20produce%20no,electricity%20when%20compared%20with%20solar.

Nuclear power plants produce no greenhouse gas emissions during operation, and over the course of its life-cycle, nuclear produces about the same amount of carbon dioxide equivalent emissions per unit of electricity as wind, and one third of the emissions per unit of electricity when compared with solar.

Governments and industry are embracing nuclear power

- European Union taxonomy approved nuclear as an environmentally sustainable investment

- US Nuclear Security Act to fund US$2.7 billion to bolster the US domestic nuclear fuel production and speed up nuclear regulatory process

- Ontario & Saskatchewan to work with GE Hitachi to build its BXWR-300 Small Modular Reactor (“SMR”) at the Darlington facility in Ontario and at a location in Saskatchewan TBD

- TerraPower is constructing it’s Natrium SMR at a former coal-fired power plant in Wyoming with financial assistance of the US DOE

Big Tech Goes Nuclear to Power AI Data Centres

Oracle announces it is designing gigawatt-scale datacenter that will be powered by three SMRs

Google signs power purchase agreement with Kairos Power to support the first commercial deployment of the KPFHR molten salt SMR

Microsoft signs a 20 year power purchase agreement with Constellation Energy to restart Unit 1 at Three Mile Island

Amazon becomes the anchor investor in US$500 million financing in X-energy to advance the Xe-100 SMR design and their TRISO-X fuel with the goal of building 4 SMR units with 320 MW capacity by 2030

US Bans Imports Of Russian-Sourced Low-Enriched Uranium

US legislation H.R. 1042 passed May 13, 2024 prohibits the importation of low-enriched uranium from Russia or Russian entities into the USA 90 days after enactment.

US legislation H.R. 1042 also enables US$2.7 billion in funding to re-start America’s domestic nuclear fuel production and uranium mining industry under the Nuclear Fuel Security Act.

"Our bipartisan legislation will help defund Russia’s war machine, revive American uranium production, and jumps tart investments in America’s nuclear fuel supply chain…”

Senator John Barrasso, Wyoming

It "simultaneously unlocks USD2.72 billion to ramp up domestic uranium fuel production…”

Senator Joe Manchin, West Virginia

In 2023, the United States…

- consumed 46.9 Mlbs of U3O8 but produced <<1 M lbs

- Imported uranium from:

- Canada (27%)

- Kazakhstan (25%)

- Australia (25%)

- Russia (12%)

- Generated 19% of their electricity fromnuclear power

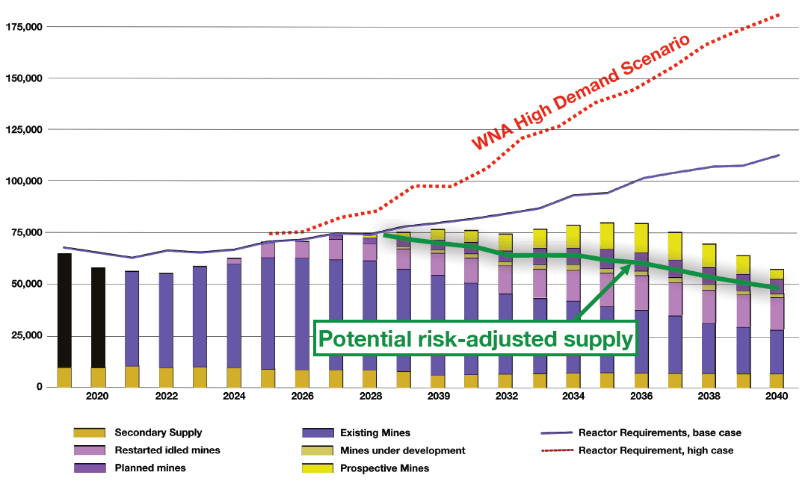

Projected Uranium Supply & Demand - Base Case (tU)

Source: World Nuclear Association, World Nuclear Fuel Report at https://world-nuclear.org/images/articles/nuclear-fuel-report-2021-expanded-summary.pdf

The WNA forecasts:

- A significant uranium supply deficit commencing in 2030.

- The actual supply gap will be much larger as their scenario includes significant production from moderate to low probability sources such as

- Planned Mines

- Mines Under Development

- Prospective Mines

- Several restarted idle mines were swing producers, unable to operate in a <US $60 / lb U3O8 price environment during the last cycle

- Chronic underfunding of the uranium exploration, development & mining sectors since 2008 has slowed the necessary pace of new supply from being discovered and developed

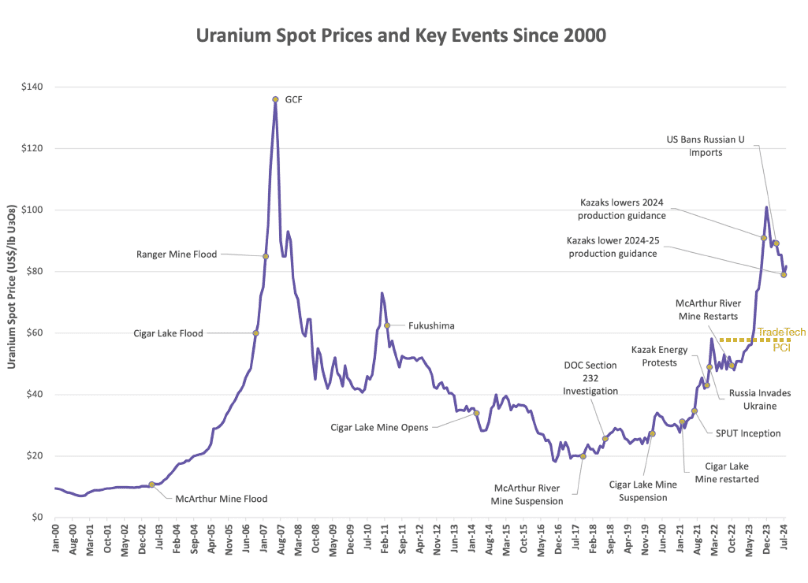

Uranium Prices Are Just Reaching Incentivizing Levels

Sources: Uranium prices from both UxC Consulting and Tradetech, events from various news sources

- Uranium prices respond rapidly to supply disruptions. Current geopolitical events are likely to ensure continued short to mediumterm supply volatility

- TradeTech’s Production Cost Index of US$58.00/lb has only recently been reached. With investors requiring a minimum return on investment, an incentivized price of US$80.00/lb is realistic

- Despite reaching incentivized pricing, chronic underfunding of the uranium exploration and development since 2008 resulted in few projects entering the development pipeline. Development timelines in most jurisdictions is over 10 years

- Current suppliers are unable to elastically respond to price increases and likely will have to prioritize investment in sustaining capital over investing in new production capacity in the medium-term

- Long-term price (US$82.00/lb) has just caught up to the spot price rise suggesting utilities believe that a fundamental change in supply dynamics are in place and that higher prices may linger for a longer period

-

UF6 and EUP prices remain very strong and supply is very tight forcing utilities to purchase U3O8

The reader is advised that the information posted was believed to be accurate at the time of posting, but that the Company will not, and specifically disclaims any duty to, update the information.